tennessee inheritance tax rate

But that wont be an. Those who handle your estate following your death though do have some other tax returns to take care of such as.

States With Highest And Lowest Sales Tax Rates

Each due by tax day of the year following the individuals death.

. The only situation where this tax might. This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an inheritance tax. Next year the Tennessee Inheritance Tax will be abolished.

No estate tax or inheritance tax. In 2021 federal estate tax generally applies to assets over 117 million. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required.

2 of taxable income for tax years beginning January 1 2019. Everyone in the 2019-20 tax year has a tax-free inheritance tax allowance of 325000 u2013 known as the nil-rate band. The federal estate tax exemption is 5450000 for 2016 and is indexed for inflation.

Tere are however no lifetime gift exemptions under state law as there are under federal law. Calculate Your Retirement Taxes in These Other States Virginia Retirement Tax Friendliness. Next 240000 - 440000.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. No estate tax or inheritance tax. 1 of taxable income for tax years beginning January 1 2020.

The schedule for the phase out is as follows for the tax rate. The top estate tax rate is 16 percent exemption threshold. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required.

However if the value of the estate is over the exempted. Also estates of nonresidents holding property in Tennessee must file Form INH 301. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

Professionals in certain occupations are required to pay an annual 400 fee in Tennessee. At the federal level there is only an estate tax. The estate tax in Tennessee was fully repealed in 2016.

In January of 2016 Tennessee repealed its inheritance tax to encourage residents to continue to live and retire within the state. No estate tax or inheritance tax. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now.

Tennessees tax exemption schedule is as follows. Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. Tennessee Professional Privilege Tax.

Final individual federal and state income tax returns. Mark Fly CPA Price CPAs PLLC 3825 Bedford Avenue Suite 202 Nashville TN 37215. Today the Tennessee Inheritance Tax exemption for 2015 is raised to 500000000.

3 of taxable income for tax years beginning January 1 2018. Tennessee is an inheritance tax and estate tax-free state. Year of death must file an inheritance tax return Form INH 301.

As of January 1 2016 Tennessees inheritance tax is fully repealed. The exemption is 1000000. The tax rate is graduated from 55 to 95.

No estate tax or inheritance tax. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. The good news is that Tennessee is not one of those six states.

An inheritance tax is essentially a tax on the amount of money or assets the heirs or beneficiaries of an estate receive. Year Amount Exempted. Information about inheritance tax can be found here.

This means that if you are a resident of Tennessee or own real estate in this state you will not have to pay an inheritance tax. The net estate less the applicable exemption see the Exemption page is taxed at the following rates. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island.

4 of taxable income for tax years beginning January 1 2017. The taxes that other states call inheritance taxes are not based on the total value of the estate. Tennessee has no inheritance tax and its estate tax expired in 2016.

The standard inheritance tax rate is 40 of anything in your estate over the Â325000 threshold. Te current top gift and estate tax rate in Tennessee is 95 and Tennessee only allows a 13000 exemption per recipient per year as does federal law. However if the estate is undergoing probate a short form.

Tennessee imposes this tax on the net value of a resident decedents estate or Tennessee real or personal property owned by a nonresident. The allowance has remained the same since 2010-11. Next 40000 - 240000.

2016 Inheritance tax completely eliminated. Inheritance and estate taxesaka death taxeshave been legislated in a number of states across the country. They are imposed on the people who inherit from you and the tax rate depends on your family relationship.

There is no federal inheritance tax but there is a federal estate tax. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. Tennessee Inheritance and Estate Tax.

Prior to 2016 Tennessee imposed a separate inheritance tax and had an exemption from that tax that was less than the federal estate tax exemption. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. Starting January 1 2016 for those who die on or after that date there will no longer be any Tennessee Inheritance Tax obligations.

Check out our Tennessee mortgage guide for information about mortgage rates in Tennessee and details specific to each county.

Does Tennessee Have An Inheritance Tax Crow Estate Planning And Probate Plc

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

Buying A Second Home At The Beach How To Buy A Beach House The Right Way In 2022 Beach Cottage Design Beach House Kitchens Beach House

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Tax Structure City Of Hendersonville

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kids Corner Chester County Solid Waste Authority Pa Chester County Solid Waste Chester

21 Sheridan Wyo Wyoming Travel Sheridan Wyoming Wyoming

State Estate And Inheritance Taxes

States That Won T Tax Your Retirement Distributions Income Tax Income Tax

Marketing Solutions On Twitter Estate Tax Mortgage Blogs Property Tax

Oklahoma Estate Tax Everything You Need To Know Smartasset

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

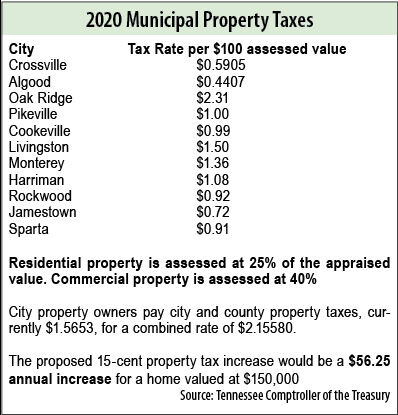

15 Cent Property Tax Increase Ok D Local News Crossville Chronicle Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tennessee Retirement Tax Friendliness Smartasset Com Federal Income Tax Income Tax Return Inheritance Tax

Rv Living How To Make It Without A House Infographic Map Real Estate Infographic Estate Tax

What Is Boot In A 1031 Exchange Youtube Exchange One Piece Episodes Carrie Anne Moss

Eight Things You Need To Know About The Death Tax Before You Die